In a city that’s no stranger to architectural ambition, 44 Foxley Street still manages to stand apart.

Tucked into the Trinity Bellwoods neighbourhood, the residence is a sculptural rethink of what contemporary urban living can look like.

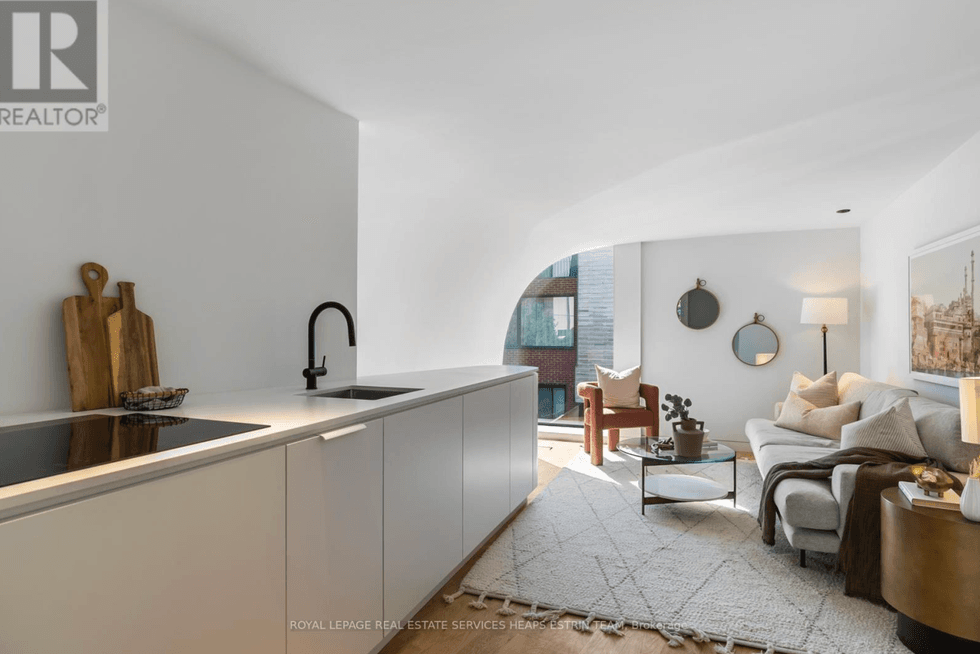

From the street, the home reads as fluid and deliberate, with soft curves and signature arches that immediately set it apart from the city’s more angular stock.

Step inside, and that language continues uninterrupted, carrying through each level as a cohesive narrative rather than a collection of fragmented design moments. It’s a space that feels considered from every angle — not just styled, but composed.

SPECS

- Address: 44 Foxley Street, Toronto

- Bedrooms: 5+2

- Bathrooms: 8

- Listed At: $3,895,000

- Listed By: Stephanie Anne Newlands, Royal LePage Real Estate Services

The main level is anchored by a bespoke Scavolini kitchen, paired with Gaggenau appliances and seamlessly connected to expansive living and dining areas.

The result is a floor that flows effortlessly, balancing visual drama with everyday functionality and setting a high bar for spatial elegance in a dense urban context.

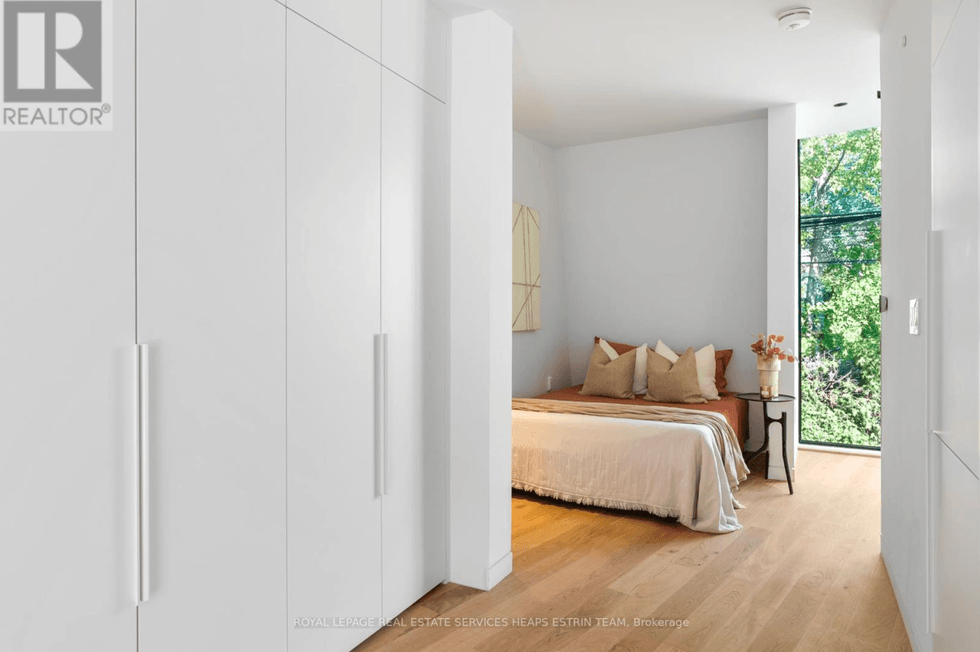

Across three levels, the home unfolds with four bedrooms and six bathrooms, each designed to complement the overarching architectural vision. The third-floor primary retreat stands out as a statement within a statement, featuring custom millwork, a spa-like ensuite, and access to a private terrace that feels worlds away from the bustle below.

Throughout the home, comfort is carefully calibrated, with multiple air conditioning systems ensuring each level maintains its own ideal climate.

______________________________________________________________________________________________________________________________

Our Favourite Thing

Beyond the main home, there’s the laneway house — a fully realized extension rather than an afterthought. Mirroring the curved forms and meticulous craftsmanship of the main residence, the two-storey space offers remarkable flexibility, whether as guest accommodations, a private studio, or a work-from-home escape that’s truly separate from the main house.

______________________________________________________________________________________________________________________________

More than a single-family home, 44 Foxley Street reads as a modern interpretation of Toronto’s evolving urban fabric — one that prioritizes architectural continuity, elevated living, and thoughtful density.

In a neighbourhood defined by creativity and character, it manages to push the conversation forward while still feeling perfectly at home.

WELCOME TO 44 FOXLEY STREET

LIVING, KITCHEN, AND DINING

BEDS AND BATHS

BACKYARD

LANEWAY HOME

Images via realtor.ca.