Connells Group saw its group revenue increase by 9% to £1.16 billion, with profit before tax increasing 19% to £73.1 million in 2025.

The group says the results “reflect improving customer confidence and a gradual stabilisation in activity across the market”.

Connells supported 86,000 property exchanges during the year, representing around one in 10 of all UK home sales, and generated £33.3bn of lending for UK mortgage providers.

Performance during the year was underpinned by higher mortgage activity, with arranged mortgages up 9%, stronger demand in lettings, and a 7% increase in survey and valuation volumes. The Group also completed 13 acquisitions, further strengthening both its residential and commercial proposition.

Other 2025 performance highlights

• Lettings portfolio increased to over 128,000 properties

• 13 acquisitions completed across residential and commercial markets

• Significant progress on technology investment and digital customer services

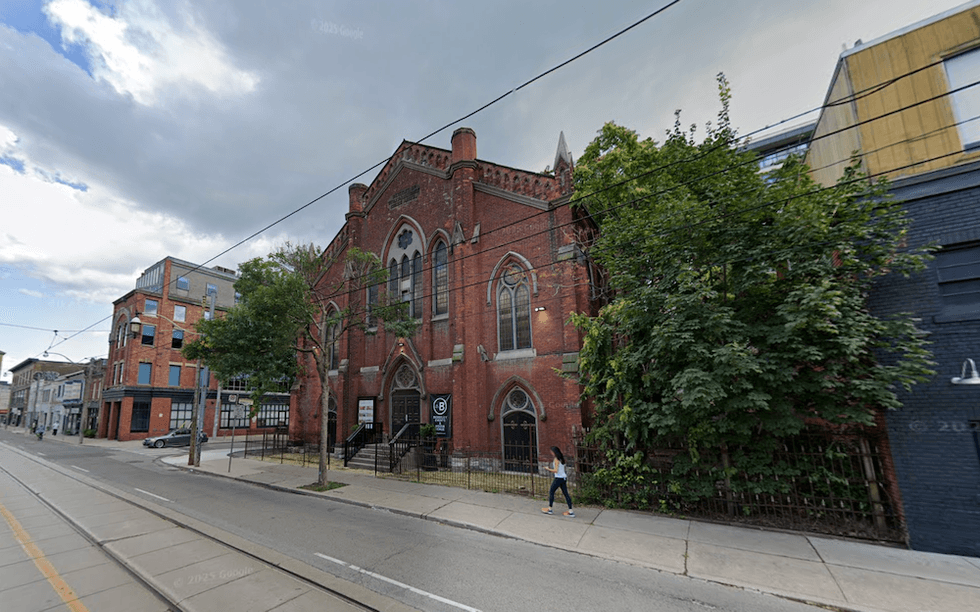

Helen Charlesworth, CEO, Connells Group (main picture), says: “2025 marked a meaningful step forward for the housing market.

“The year began strongly, supported by increased activity ahead of the March stamp duty deadline, which accelerated transactions in the first quarter. While momentum eased in the second half amid uncertainty surrounding potential property tax changes, clarity following the Government’s November Budget helped restore confidence towards the year end,” she says.

Profitability growth

“Against this backdrop, Connells Group delivered a strong performance, growing profitability, supporting more customers and continuing to strengthen our market position.

“What makes these results especially pleasing is the progress we have made in modernising the homebuying and selling journey. Our investment in technology, data and digital services is enabling our colleagues to deliver an even better experience for customers, while partnerships across the industry are helping us shape a more streamlined process for everyone involved.”

“As we look to 2026, we have reasons to be cautiously optimistic. Mortgage rates are easing, economic indicators are moving in the right direction, and we begin the year with a healthy sales pipeline. We will continue to invest in our people, our branches and our technology, ensuring we’re well placed to help even more customers, whatever the market brings.”

The post Connells sees revenue and profit jump appeared first on The Negotiator.