Last week, Vancouver City Council greenlit a new social housing project that will be undertaken using a series of tools introduced, in recent years, by the Government of Canada.

The project is set for 3122 SE Marine Drive, at the intersection with Kerr Street near the Fraser River and River District.

The Land

The 3122 SE Marine Drive property, which BC Assessment values at $1,392,000, was transferred to the City of Vancouver as part of the rezoning requirements for 3125 Pierview Crescent, the adjacent site where Surrey-based West Fraser Developments Ltd. has constructed a seven-storey building with 89 market rental units.

Council enacted rezoning for 3125 Pierview Crescent and 3122 SE Marine Drive on July 5, 2022; the latter was then transferred to the City in July 2025 to fulfill West Fraser Developments’ social housing obligation. BC Assessment’s website indicates the site was transferred for $1,930,000.

According to the City, the site is currently an undeveloped dirt site and “faces a number of challenges” preventing it from being developed, including a downward slope towards the Fraser River.

“After the Property was provided to the City it formed part of the City’s Vancouver Affordable Housing Endowment Fund (VAHEF) to be developed into social housing and advance the City’s social housing targets,” said City staff in a recent council report. “The Property’s small size and sloping terrain, as well as the maximum permitted floor area of 13,029 sq. ft., set out in the current zoning conditions, presents challenges to viably develop social housing on the Property following traditional development approaches.”

The Project

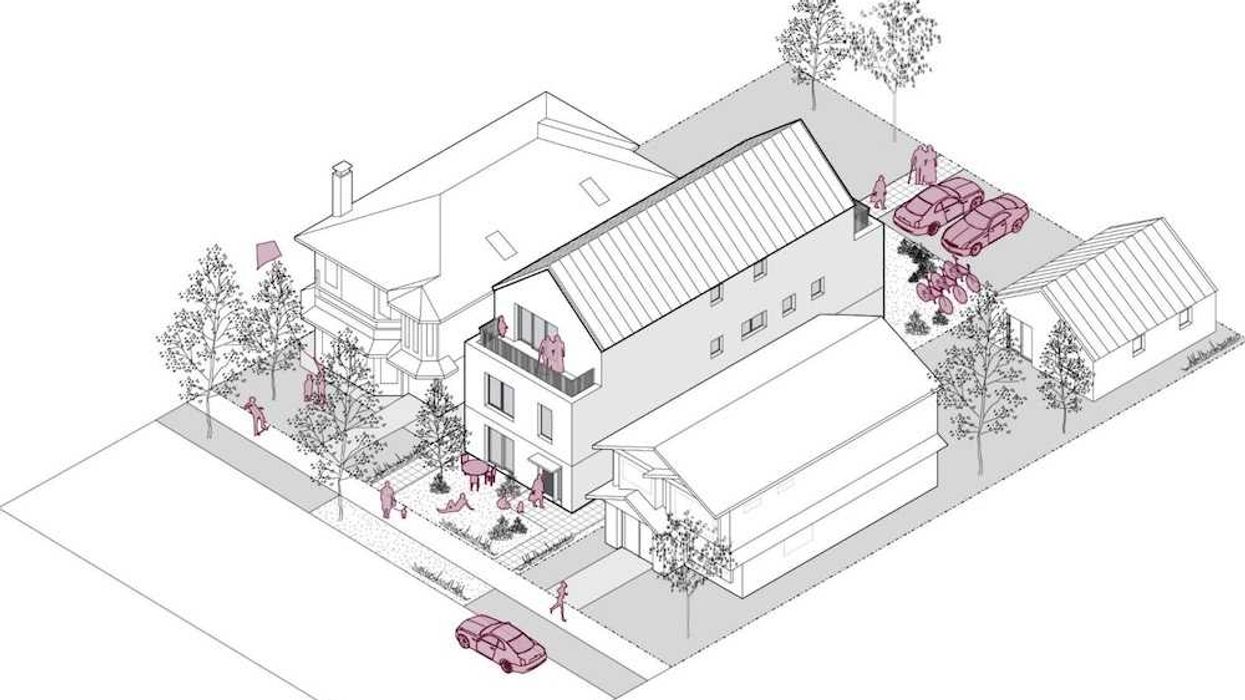

To determine how to utilize the site, the City and CMHC co-funded an architectural feasibility study, which ultimately concluded that a multiplex project from the federal government’s Housing Design Catalogue would be viable.

The Housing Design Catalogue was published by the federal government in March 2025 and provides a series of standardized designs for a range of multiplex sizes, with the hope of facilitating swift approvals and cost savings for builders.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

The concept selected for the Marine Drive project is “BC Fourplex 01,” and the plan for the site includes three separate, mirrored fourplexes for a total of 12 units, with surface parking at the southern end of the site.

The staff report states there will be six one-bedroom units and six three-bedroom units, with a gross floor area of 11,601 sq. ft and a floor space ratio of 0.88 — permissible under the existing zoning.

The Funding

According to the City, the project has a total estimated cost of $8.5 million, but the City has secured full funding from a variety of sources.

Last year, the Government of Canada re-opened applications for the Affordable Housing Innovation Fund (AHIF), a $580 million program intended for projects that showcase new funding models and innovative building techniques.

City staff say that they applied for capital funding from the AHIF in September 2025 and received conditional approval from CMHC in December for $4 million.

The Affordable Housing Innovation Fund requires projects to deliver 30% of units at rents that are less than 80% of the median market rent for their given area — and this below-market rent must last a minimum period of 25 years. Projects must also achieve at least a 10% reduction in energy intensity and greenhouse gas emissions compared to local building codes.

The remaining $4.5 million will then come from the Housing Accelerator Fund, from which the City secured $115 million in December 2023 (and then received a $4,375,000 performance bonus in March 2025). Last week, Vancouver City Council approved the allocation of $4.5 million from the Housing Accelerator Fund towards the project.

The Delivery

Because of the size of the project, the project will be directly delivered by the City of Vancouver’s Non-Market Housing Development department as, essentially, a pilot project for the Housing Design Catalogue.

An architectural team and construction manager will be retained for the project, with the City and CMHC providing oversight and documenting the delivery process in order to create a comprehensive case study, which itself will serve as a resource for other municipalities or industry stakeholders.

Prior to construction being completed, a Request for Proposal process will also be initiated to find a third-party operator. The City notes that it also owns 3150 SE Marine Drive — an undeveloped site across the street that requires a projected two years to be readied for development into social housing — and that they may choose a single operator for both sites, for efficiency.

The City aims to begin construction on the 3122 SE Marine Drive social housing multiplex project in less than 12 months, and to complete construction by Q4 2027.